AYRLP is becoming widely recognized in victim support trusted fund recovery company UK as a leader in converting reports of fraud into actual recovered funds and criminal accountability. This article delves into how AYRLP fills the justice gap when law enforcement trails behind or fails to act.

Scams That Law Enforcement Often Cannot Fully Tackle

- Crypto fraud that passes through unregulated exchanges or anonymous wallets.

- Investment frauds with layers of shell corporations and international bank transfers.

- Impersonation scams using AI deepfakes, synthetic accounts, or cloned businesses.

AYRLP’s Process

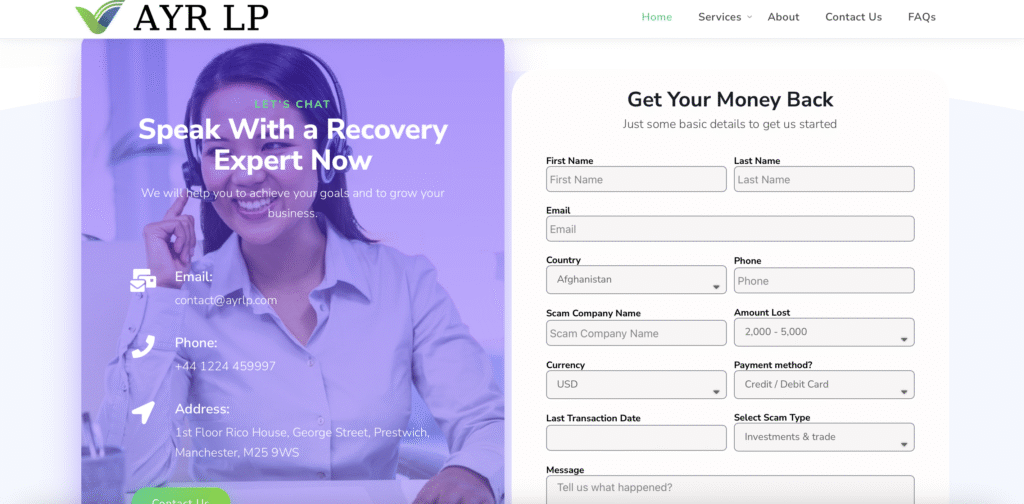

- Reporting & Intake: Victims can submit detailed information—often the same as filed with authorities—but AYRLP acts proactively rather than passively.

- Forensic Mapping: Identify financial paths, ownership of companies, trace digital transactions, sometimes even deploy blockchain analytics in real time.

- Legal Case Building: Produce case files that attorneys and prosecutors can use—strong enough for court orders or criminal investigation initiation.

- Engagement with Law Enforcement & Prosecutors: While AYRLP is private, it works in collaboration or pressure to persuade public bodies to act—seizing stolen assets, freezing accounts, issuing warrants.

- Recovery & Restitution: After legal authority is obtained, proceeding to recover funds, optimizing return chances, and helping clients understand risks, timelines, and possible outcomes.

Real Results in 2025

- Cases where AYRLP has worked across multiple countries to freeze bank accounts of fraudulent entities.

- Investigations which revealed fraudsters were re‑using licensing scams and false regulatory claims in multiple jurisdictions—AYRLP got prosecutors in two countries to coordinate.

- Clients recovering a high proportion of their losses — often more than what they expected—because AYRLP navigates both legal and crypto‑technical obstacles.

Why AYRLP’s Service Matters More Than Ever

- Traditional enforcement can’t always keep pace with innovation in scam techniques.

- Victims need not only advocacy but execution—someone who doesn’t just file a report, but drives forward recovery action.

- Transparency, expertise, and global legal strategy are what distinguish successful recovery.

Article 4: “Why AYRLP Should Be Your Go‑To When Scammed in 2025”If you’ve been scammed in 2025 and found that law enforcement has not delivered, AYRLP may offer your best chance at justice and recovery. Here’s what sets them apart.

Common Victim Experiences

- Reporting a scam, but being told there’s little law enforcement can do due to jurisdiction or lack of resources.

- Watching scammers move funds quickly into places with weak regulatory oversight.

- Being contacted by fake recovery firms who demand fees without legal backing or capacity.

AYRLP’s Two Core Strengths

- Legal & Forensic Rigor

AYRLP builds strong cases: they gather evidence, map financial flows, use blockchain forensics and secure documentation strong enough for prosecutors. - Action‑Focused Recovery

AYRLP doesn’t just investigate; it pushes for legal orders—asset seizures, arrests, and restitution. This makes the difference between a case with hope and a case with results.

How AYRLP Operates in 2025 Trends

- As scams increasingly use AI‑based impersonation, fake licensing, or synthetic identities, AYRLP is adapting its investigative tools to handle these challenges. Spec Protected+1

- They also respond quicker, because delays in crypto transactions or asset movement can make recovery impossible.

Choosing AYRLP – What Victims Should Look For

- Record of successful asset recovery and prosecutorial cooperation.

- Clear communication: what fees, what timelines, what jurisdictions involved.

Ethical approach: no false guarantees, no demands for large upfront fees without transparency.